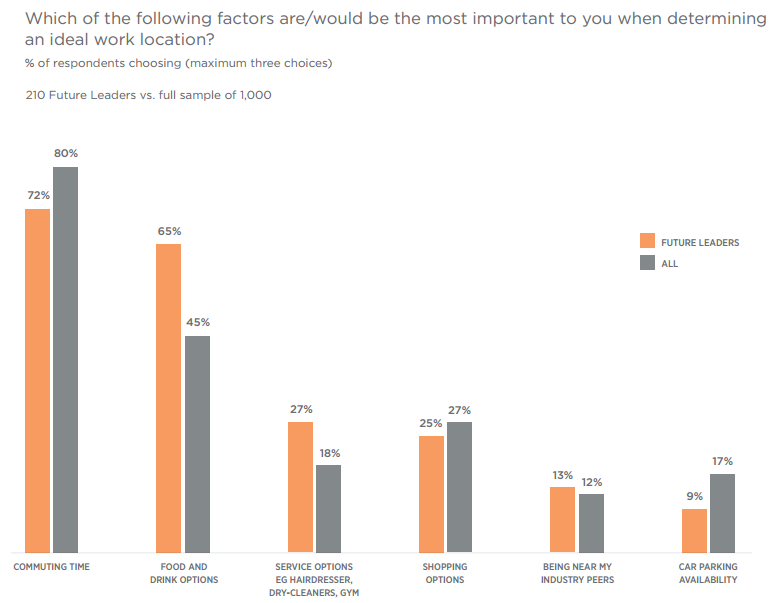

In our Office Futures survey, we asked London office employees what factors were most important to them when considering an ideal work location.

Employees, unfortunately, do not determine their employer’s location, these are board-level decisions. However, in the longer term it is not unreasonable to expect that firms will give considerable consideration to whether a location is a positive or negative for their employees. Indeed, businesses in London have become increasingly focussed on this issue, as the ‘war for talent’ in the city hots up amid rising house prices and a technological skills gap in many sectors.

A key factor in our survey question was the limiting of respondents to a maximum of three answers, this forces them to make a trade-off between options that would all be nice, but in the real world perhaps not all possible.

The grey bars are our full sample of 1,000 London office workers. From this data it is clear that ‘commuting time’ is far and away the most important factor. Now, this may seem obvious; but the most expensive office locations (to rent) in London at present are not necessarily the best connected ones. King’s Cross, for example, at £80 per sq. ft. remains cheaper than the West End core locations, yet its transport connectivity is superior. Crossrail, due to start most services in 2018, will shift the plates of London’s office market further; pushing cheaper locations, such as Canary Wharf, up the transport connectivity spectrum.

The other key location factor for employees is ‘food and drink options’. We have, of course, seen a considerable expansion of the frequency of eating out in the last decade or so (particularly so in London), and these survey results seem to reflect that. However, what they further illustrate to us is the fact that employees view their workplace’s locational attractiveness as being explicitly tied into the range of food and beverage options within the vicinity. We have seen office-dominated business districts graduate towards a mixed-use model, and would suggest that this trend has some way to go.

The orange bars in the chart above, lay out the responses of our ‘Future Leaders’ sample – the 210, 18-34-year-olds earning £35,000 per annum or more. Their answers do not deviate hugely from the wider sample, with the exception that they place even more emphasis on ‘food and drink options’ as an attractive location factor. This would support our hypothesis in the previous paragraph regarding the growth of food and beverage in business districts.

However, we are left with the question: “what does a good food and beverage offer look like for office workers going forward?” We are, after all, seeing considerable structural change in the retail sector, think online retail, pop-up retail; street food, ‘bricks-and-clicks’ and experiential retail, to name just a few key trends. Some of the most dynamic retail environments in London are now orientated around street food and/or more fixed, but still flexible and short-let, food markets. Borough Market, Brixton Market and Maltby St Market to name just three. Whilst the street food collective Kerb’s residency at King’s Cross has proved key in attracting footfall to the area and altering perceptions – a concept that has now rolled out to several other sites.

It is always dangerous to be too prescriptive when making predictions, but I think we can expect London’s established order of office locations to come under increasing pressure in the coming years as public transport projects such as Crossrail complete. Whilst street food, or food markets, will have an increasing role to play in ensuring locations’ food options are both varied and of a high quality.

Read the full Office Futures survey.